dengem'in psikologları bir tık uzağınızda ve sorunlarınızı çözmenizde size yardımcı olmaya hazır.

Her gün kendinize kişisel zaman ayırın!

Size iyi gelen şeyleri sık sık tekrarlayın.

Her şey her an yolunda olmak zorunda değil.

Kaybedince üzülme, hayatın ne getireceğini bilemezsin.

İnsanlara sevgiyle bak ki, hayat seni sevgiyle kucaklasın.

Her gün birini mutlu et, tabi kendini de.

Kendine kötü sözler söyleme!

En yakın arkadaşın kendin ol!

Diğer insanlarla iken maskeler takma, onlar seni sen olduğun için sevmeli.

Kendini olduğun gibi kabul et ve sev.

Her konuda başarılı olamazsın.

Enerjini tüketen insanlara sınır koy.

Herkesi memnun edemezsin, memnun olmamaları onların tercihi.

Yardım istemekten çekinmeyin. Her şeyi tek başınıza yapmak zorunda değilsiniz.

Hatalarınız gelişiminizin bir parçası.

En çok da kendine ihtiyacın var. Kendine iyi davran.

Kendin olmanı engelleyen her şeyden uzak dur.

Ne kadar özsaygıya sahipsin? Bunu belirlemek ve korumak senin elinde.

Hayır demek seni korur. Hayır demekten çekinme.

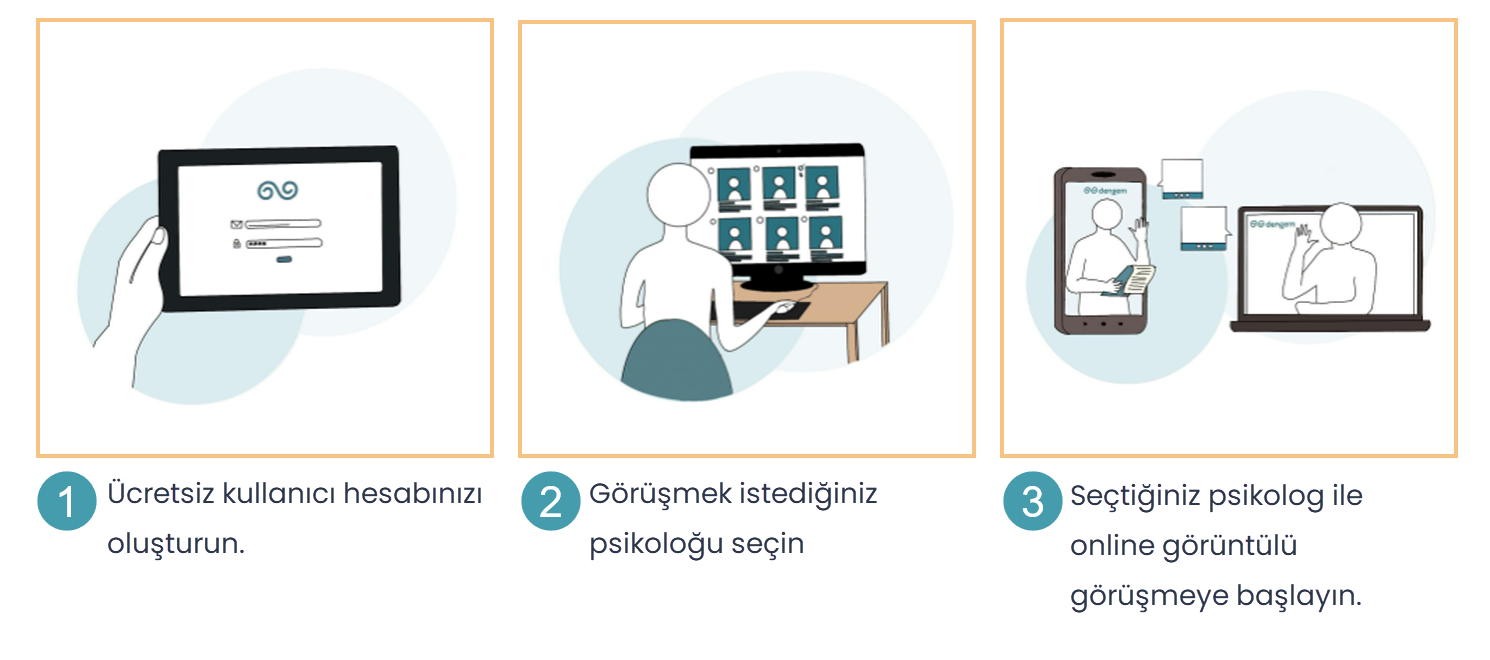

Dengem ile Profesyonel Terapistlere Bağlanın

Ruh Sağlığı Yolculuğunuzda Dengem ile Güçlü Olun

Herkes İçin dengem: Kaliteli Ruh Sağlığı Bakımı

dengem: Sizin Kişisel Gelişim Platformunuz

Online Ruh Sağlığı Destek: dengem

Dengem ile Size En Uygun Psikoloğu Bulun